Good afternoon friends! I have always been interested in the question of whether there are pensions in Japan. Now so many young people are leaving for Japan and it is not a fact that they will live there until old age. So what then? Where will the contributions that were paid go? Can a foreigner receive a Japanese pension? What is a pension in Japan in form and content? From time to time I asked Fujitu-san questions about pensions, but either the topic was not interesting for him, or I did not find the right questions, but from our conversations I only understood that there are pensions in Japan, there are two types of them - state / national and corporate, and the later you retire, the higher it is.

I didn’t take up this topic for a long time, believing that any pension system is a very complex and confusing legislation. Having searched for the necessary information, I will try to talk in general terms about the Japanese pension system.

Japan, the country with the highest level of life expectancy, was 83.98 years in 2021. Traditionally, women live longer than men, the average age is 86.83 years and this is 1st place in the world, the average life expectancy of men in Japan is 80.5 years (3rd place in the world). With such a high life expectancy, Japanese men and women retire relatively early at the age of 65. Accordingly, the financial burden on Japan's pension system is very high and causes concern for the government and population. Already, every fourth person in Japan is an elderly person over 65 years of age.

The aging of society is a phenomenon that many countries around the world face to one degree or another, but Japan is distinguished not only by the scale of the proportion of the elderly population, but also by the pace of aging of society. There is such terminology as “aging society” and “old society”. If in a country more than 7% of the population is over 65 years of age (retirement) age, such a society is called aging, but if this figure exceeds 14%, then it is already an “old society.” In Japan, the ratio of people over 65 years of age to the total population is 25.9%. And Japan went from an aging society to an old society in a record time - 24 years, from 1970 to 1994.

Therefore, today the pension system in Japan is constantly in the process of changes, making it possible to approach the time when the elderly part of society begins to predominate over the young working-age part of the population at lower costs. Today in Japan there are 24 million people over 65 years of age, a year this figure increases by approximately 600 thousand people. There are 69.5 million people of working age making payments to the pension fund; in 2050, the figure will decrease to 45.3 million people. That is, if now there are about 3 workers per pensioner, then in 2050 the number of working-age population will be reduced to 1.5 people.

Who is covered by the Japanese pension system?

Any person living and working in Japan, regardless of citizenship and nationality, must be included in the state pension system. This means that all persons between 20 and 59 years of age are required to enroll in national insurance and pay contributions.

Can a foreigner refuse to pay insurance premiums? - No. This is the responsibility of everyone living in Japan. If I’m not confused, even when coming to study at a language school, insurance premiums are withheld from students. Disabled and unemployed people can apply to their local municipality every year for a reduction in their insurance premiums.

Payment of contributions for the formation of a national pension is mandatory and does not depend on the fact of work. The National Pension was first established in 1961 for the self-employed and non-working population. Citizens independently made fixed payments to form their future pension. At first, contributions were insignificant in amount, with a gradual increase and, for the interest of the population, were co-financed by the state. In the same 1961, another category was added - spouses who are dependent on full-time workers. Since 1986, their participation in the national system has become mandatory, with certain features that will be discussed below.

Pension Fund

As already mentioned, the pension fund in Japan is quite large. However, the question remains open: why, having the same number of working population, cannot other developed countries create the same pension system as in Japan? Experts say there are two main reasons for this:

- The process of accumulating reserves has not yet been completed. And in the case of economic growth, the growth of the fund will not keep pace with the increase in social welfare.

- Countries do not change the system of automatic accrual of pension payments. Simply put, insurance premiums are automatically transferred as pension payments. Accordingly, the government has no reason to create a reserve savings fund.

Pensions in Japan are one of the highest in the world and all thanks to the savings fund, but it is also important to understand how the Japanese generally relate to money.

Retirement age in Japan

Until 2001, the retirement age in Japan was 60 years, then the retirement age began to increase by 1 year every 3 years and in 2013 it reached 65 years.

Payment of the pension can begin at the age of 60, in which case its size will be only 70% of the amount due. At 65 years of age, the pension is set at 100% and upon retirement at 70 years of age, the pension will be 142% of the established amount, while the establishment of a pension at 70 years of age is mandatory. That is, the Japanese have the choice to retire at 60 or 70.

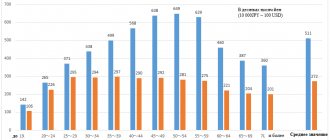

Amount of payments to Japanese pensioners

The size of old-age pension payments depends on a number of parameters:

- Main part. About 73% of the total amount is accrued monthly from the Pension Fund if a person retires at the age of 65. If you stop working at age 60, the amount of financial assistance is reduced by 30%. The average value of the social pension fluctuates around 74.5 thousand yen ($700).

- Professional pension. An important point regarding the calculation of financial assistance of this type is whether a person belongs to a certain category of workers. For example, for those who are interested in what kind of pension civil servants have in Japan, let us inform you: they receive approximately 2/5 of their salary. Savings for subsequent cash assistance in old age are formed from employee contributions to the Pension Fund in the amount of 5% of earnings. In addition, the employer transfers money to his employee’s account in the Pension Fund.

- One-time benefit. The payment amount is calculated using the formula:

SV = EO × KOL, where

SV – payment amount, required parameter;

EO – monthly salary;

KOL – number of years worked at the company.

According to statistics, the average pension in Japan in 2021 is 159,645 yen (1,500 dollars or 100,059 rubles). This is 60% of the average salary in Japan.

Even the minimum pension in the archipelago, equal to 63,830 yen (600 dollars or 40,048 rubles), is several times higher than the average value of this indicator in Russia (14,100 rubles) and, for example, in China (for rural residents - 1,238 rubles, and for urban - 2,4006 rubles).

Detailed information about the pension program in the People's Republic of China is presented in the article “Pension and pension system in China.”

Considering that a person in old age does not need to spend money on raising children or purchasing housing, such provision for old age can be considered quite worthy.

To have an idea of the standard of living in the Land of the Rising Sun, read the article “About life in Japan: conditions, cost, mentality.”

Against this background, it is not at all surprising that the most expensive trading enterprises in the Land of the Rising Sun with goods of well-known brands are aimed at elderly buyers. After all, their solvency is at a high level.

Thanks to the inherent thrift mentality of the Japanese, over the years, pensioners, as a rule, have managed to create their own financial savings. In combination with a pension, this allows older people to acquire even things that they previously denied themselves.

What is the amount of insurance contributions transferred to form a pension in Japan?

Insurance premiums are paid monthly, and the amounts depend on the category of employee.

- Self-employed people, students, farmers aged 20 to 59 paid a fee starting from 14,660 yen per month. Each year the fee increased by 280 yen and will eventually amount to ¥16,900. In 2021, this contribution amounted to ¥16,340. This category of citizens must independently contact the pension department of the municipality at their place of residence and go through the procedure for joining state insurance.

- Employees working in companies, enterprises pay 15.704% of the monthly salary. This contribution is paid by both the employer and the employee personally 50/50 and for each party is slightly less than 8%. At the same time, the contributions go both to the national pension fund and in the form of subsidies for the company. The procedure for joining state insurance is carried out by the employer, who also deducts contributions from wages and transfers them to the fund.

- For public sector workers and school teachers, the monthly contribution varies from 12.2 to 15.1%, and is also paid 50/50, with part of the contributions transferred to the pension fund and part to the mutual assistance fund. Entry into legal relations is carried out similarly to that set out in paragraph 2.

- Another significant category of persons are spouses who are dependent on citizens listed in categories 2 and 3 above. Spouses (non-working family members) are exempt from paying contributions and in the future will be pensioned from the contributions of the working family member. However, their pension will be significantly lower and only the national pension will be paid. The procedure for joining state insurance is carried out by the employer at the spouse’s place of work.

- In Japan, there are many people working in hourly jobs and people hired for temporary jobs - they can be paid a state pension, subject to payment of monthly pension contributions, but to form the labor part of the pension, a certain average annual income level and hours worked are required, at least 30 hours per day. week.

What is the pension in Japan? Types of pensions

What can you expect, what amount of monthly allowance will you receive when you retire? It is clear that everything is very individual and depends on the length of service and the amount of salary from which contributions were deducted. But if we take average numbers, then:

The first level, the national pension, is available to everyone, but is paid only if contributions have been paid for at least 25 years. The payment of this pension is made in a fixed amount and depends on the time during which contributions were paid.

The pension is paid in full if the period of payment of contributions is at least 40 years. The national full pension is ¥66,000, which is approximately 15% of the average salary in Japan. The national pension is indexed depending on the level of inflation. In addition, part of the national pension payments is covered by the state.

If we consider a citizen working in the private sector and his non-working spouse, with a working period of 40 years, their family monthly combined income will be 232,000 yen.

A citizen who has worked for 40 years (not the self-employed population) can count on an old-age pension of 180,000 yen. For women, the pension is usually half as much, but this is due to the fact that many women stop working after the birth of a child or work part-time.

The following types of pensions are provided in Japan:

- old age pension

- disability pension

- survivor's pension

- lump sum payment in case of death

There is another type of pension provision in Japan: corporate and individual pension plans. Typically, this is a lump sum payment, in a predetermined amount, paid upon retirement. With 20 or more years of work experience, such payment amounts to 10-12 annual income of the employee and averages 25 million ¥. Approximately 85% of Japanese employers follow this scheme.

How many?

Contribution amounts vary greatly depending on different circumstances. Therefore, there is no cast iron guarantee on the amount you will receive.

Let's look at a self-employed person in Category 1 who has been contributing to the basic national pension for 40 years. Upon reaching age 60, their monthly payment will be 66,000 yen per month (100 yen = $0.94)

I know this doesn't sound like much, but remember this is based on the Basic National Pension only.

As another example, let's consider the case of a husband and wife, one of whom is a member of category No. 2, and the other is a dependent of category No. 4. Based on 40 years of contributions, their combined pension would already be 232,000 yen per month.

60% of single Japanese working women are poor.

Due to Japan's continuing demographic problems, the pension and health insurance systems have been in a state of almost constant change in recent years. Like everything else in the country, it is greatly affected by its aging population. No one knows what will happen in the future when the population declines even further. However, the government currently states that everyone is guaranteed a pension as long as they pay into the Pension Fund. They also promised that pension payments would not be lower than 50 percent of average wages.

Views: 1,248

Share link:

- Tweet

- Share posts on Tumblr

- Telegram

- More

- by email

- Seal

Liked this:

Like

Types of pension system in Japan

There are 3 types of pension relationships that everyone working in Japan must enter into, regardless of whether the job is permanent or temporary. The old-age pension consists of two parts 国民年金 / Kokumin nenkin the basic national pension and 厚生年金 / Kōsei nenkin, the labor part of the pension.

- Basic national pension 国民年金 / Kokumin nenkin / national pension plan. It is paid to all citizens who have reached retirement age, regardless of whether they worked or not, but subject to mandatory monthly transfer of pension contributions. As a rule, this part of the pension is received by people who had their own business. The same type of pension also applies to foreigners working in Japan. When returning home, part of the pension contributions may be returned (but more on that below).

- The labor part of the pension 厚生年金 / Kōsei nenkin / employee pension insurance plan is established for persons who worked in hired work and received wages from which pension contributions were withheld. The labor part is added to the basic national pension. At the same time, it was said above that working citizens are divided into two parts: those working in private companies/kosei nenkin and in state/municipal (including teachers) institutions/kyosei nenkin. Taking into account the fact that their percentage of pension contributions is different, ultimately their pension amounts are also different.

So, from the above it follows that persons covered by the Kōsei nenkin pension system pay more pension taxes throughout their lives, but their pension is also much higher.

A foreigner who pays insurance premiums under the Kosei Nenkin system can count on a partial refund of money in a lump sum if leaving Japan. To do this, you should contact the regional offices of the state insurance system.

After registration in the state insurance system, a 年金手帳 / Nenkin-techō - pension book is issued. From this moment on, it should be kept, since it will be needed at the moment when it is necessary to decide on the establishment or payment of a pension. Of course, if lost, it will be restored, but it is still recommended to have the original. If you lose your pension book, you must immediately restore it either by contacting the municipality (category of citizens specified in paragraph 1) or contacting your employer (category of persons specified in paragraphs 2.3)

How are insurance premiums paid?

In Japan, the fiscal year begins on April 1st. At this time, citizens of working age receive envelopes full of national pension accounts. Payments can be monthly or quarterly. Payment of insurance premiums is made at the post office, in stores or at a bank. Payment receipts should be kept.

Sometimes companies, in order to avoid the cost of paying insurance premiums, can hire part-time workers. The fact is that if an employee works 75% or more of full time, then the employer is obliged to pay 50% of the employee’s mandatory payments. If, with a 40-hour work week, they are hired for 29.5 hours or less, then in this case the pension is formed only at the expense of the employee himself. In fact, it turns out that the employee has to pay larger monthly payments, and as a result, such employee will receive a significantly smaller pension.

A similar situation may arise when an employee is hired for two separate jobs, while opening two separate accounts for transferring wages. In this case, contributions will have to be paid from two salaries, while the employer will be excluded from his part of the payments.

Is the Japanese pension system reliable?

As already written above, there are big problems in Japan: society is aging rapidly, the percentage of the working-age population is rapidly decreasing, and therefore the pension system is in a state of constant change. First, the retirement age was increased, then mandatory fixed pension payments to the national pension plan and the percentage of transfer of insurance pensions in the employee pension insurance plan were increased. The percentage of pension to wages is gradually decreasing. Previously it was 60%, but is gradually decreasing. The Japanese government promises that the figure should not fall below 50%.

There is talk about increasing the (mandatory) retirement age to 70 years, since today's generation of pensioners is ready to continue working after 65 years.

On the website of the Japanese government you can get official information about the conditions of pension provision, including in Russian.

General information

Elderly people in the Land of the Rising Sun began receiving regular financial assistance from the state in 1942. A third of payments under the “Public Pension” program were made from the state budget. The remaining part was formed through contributions from employed citizens, as well as individual entrepreneurs.

In fact, Japan's pension system began to work only after the reforms carried out in 1954, when the country's economy, which had emerged from the post-war crisis, stabilized. The norms of the updated Japanese legislation guaranteed monthly payments to all members of the population who are working and have crossed the age limit of 60 years.

The Pension Fund (PF) was subsidized by the state. The bulk of the fund included contributions from employers and working citizens (in a 50/50 ratio).

The rate of tax contributions to the Pension Fund gradually increased:

- in 1961, 3.5% was levied on wages;

- by 1996 the rate had increased to 16.5%.

Today, the assets of the Japan Pension Fund exceed 170 trillion yen ($1.61 trillion).